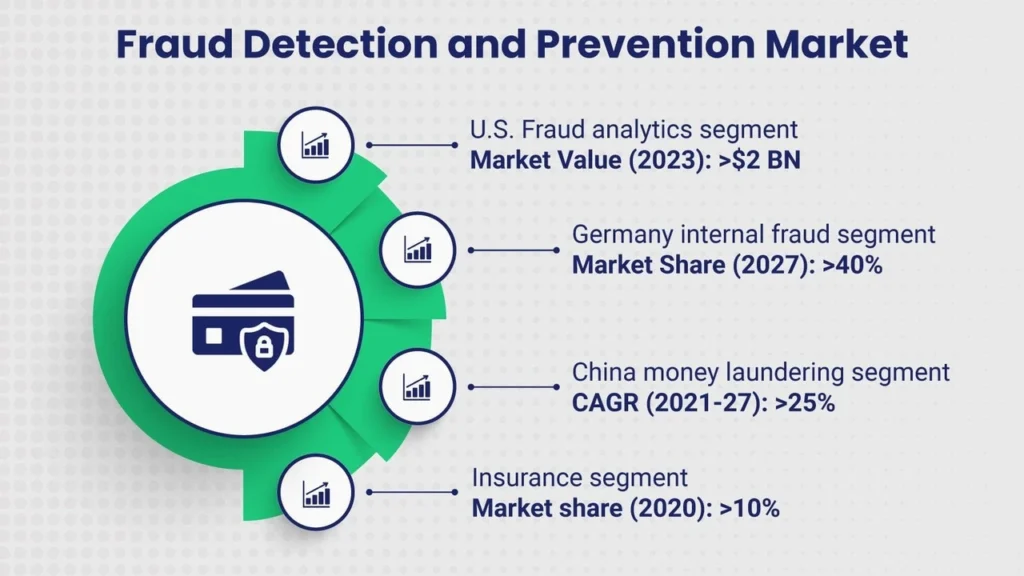

Fraud & Risk Management: Identifying Fraudulent Activity and Managing Financial Risk In the ultra-modern and increasingly digital world, robust fraud detection and hazard management structures can not be overstated. As financial transactions become more complicated and voluminous, the capability for fraudulent pastimes grows. Businesses and monetary establishments ought to undertake state-of-the-art techniques to hit upon and mitigate these risks, ensuring the security of their operations and the agreement of their stakeholders. This article delves into the essential aspects of fraud & risk management, exploring the strategies used to become aware of fraudulent activities and efficiently manage economic risks.

Understanding Fraud & risk management:

Fraud detection includes identifying dishonest or illegal sports geared toward economic advantage. These sports can range from credit score card fraud and identification theft to complex monetary statement fraud. Effective fraud detection systems hire an aggregate of techniques, along with:

Read also: 5 Powerful Yoga Asanas to Lower High Blood Pressure Easily

Data Analysis and Monitoring:

Continuous monitoring of transactions and financial information is crucial. Advanced facts analytics can detect unusual patterns or anomalies indicating fraudulent conduct. For example, unexpected fraud detection & risk management can cause spikes in transaction volumes, or deviations from established patron conduct can cause indicators.

Machine Learning and Artificial Intelligence:

This technology beautifies fraud detection competencies by reading massive datasets to discover hidden styles. Machine learning algorithms may be skilled in apprehending the traits of fraudulent transactions, improving the accuracy of predictions over time. Rule-Based Systems: Traditional rule-primarily based structures use predefined standards to flag doubtlessly fraudulent sports. While they may be much less flexible than AI-based systems, they provide an honest method for catching well-known forms of fraud.

Behavioral Analytics:

By information traditional consumer behavior, systems can encounter deviations that may recommend fraud. For instance, if a person’s account is accessed from an uncommon area or device, it would imply unauthorized entry to the fraud & Risk Management in Financial Institutions. Control involves figuring out, assessing, and mitigating risks to decrease ability losses. In the financial area, this encompasses various risks, including credit hazard, market threat, operational chance, and fraud risk. Effective change control strategies encompass:

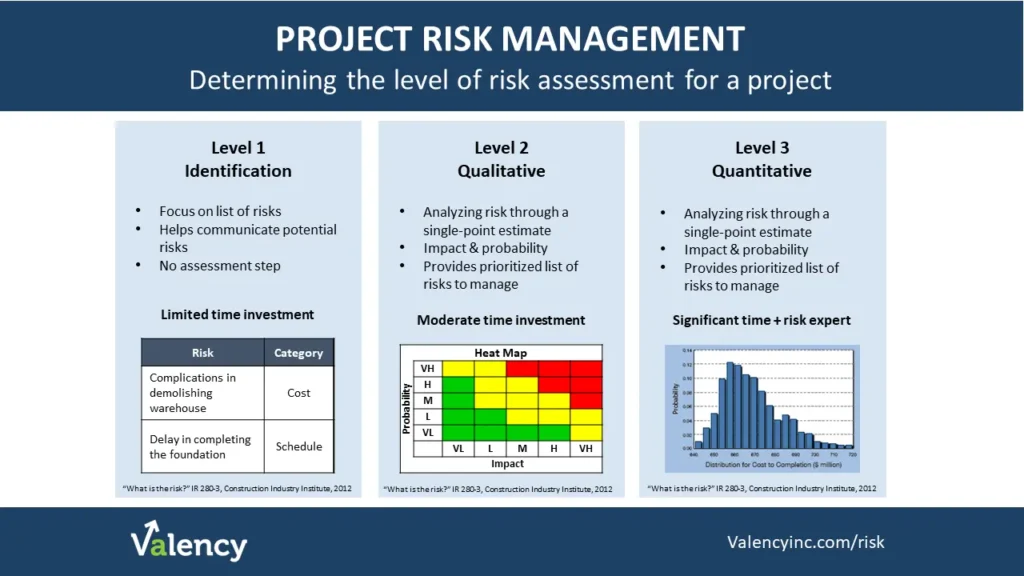

Risk Assessment:

Regularly assessing the threat panorama helps institutions apprehend wherein vulnerabilities lie. This involves evaluating each inner and outside threat, from cyber-assaults to monetary downturns. Internal Controls: Establishing sturdy inner controls is critical for preventing fraud. This consists of segregating responsibilities, enforcing strict entry to controls, and conducting ordinary audits to ensure compliance with policies and approaches.

Regulatory Compliance:

Adhering to regulatory requirements helps mitigate criminal and reputational risks. Financial institutions should be updated with rules, including the General Data Protection Regulation (GDPR) and the Sarbanes-Oxley Act, which mandate stringent information safety and economic reporting requirements. Insurance: Purchasing fraud insurance can offer a financial safety net in the event of vast fraud losses. This can be a vital part of a broader risk management method.

Employee Training:

Educating personnel about the signs of fraud and the importance of adhering to safety protocols. Well-informed personnel are more likely to come across and save you fraudulent sports.

Integrating Fraud & Risk Management :

Fraud & risk management ought to be included for the highest quality protection. This holistic technique ensures that each capability danger is considered and mitigated comprehensively. Key steps consist of Unified Platforms: Utilizing systems that integrate fraud detection and threat control skills can streamline processes and improve efficiency. These platforms can offer real-time records, facilitating quicker responses to rising threats.

Cross-functional collaboration: Encouraging collaboration among specific departments, such as IT, finance, and compliance, guarantees a cohesive approach to risk control. Each branch brings a unique angle and know-how, improving universal danger mitigation efforts. Continuous Improvement: The risk landscape evolves, so establishments must regularly update their techniques and technology. This involves staying knowledgeable about contemporary fraud and risk management processes and investing in superior detection gear.

Fraud & risk management there is the chance control are essential additives to financial safety. By leveraging superior technologies and adopting complete risk control strategies, businesses, and monetary establishments can shield themselves from the ever-growing chance of fraud. Through continuous monitoring, adequate internal controls, and move-useful collaboration, they can ensure their operations remain steady and resilient in the face of evolving risks.

To get more of our exclusive content on Health Care and Lifestyle. Follow us on YouTube and Instagram.